1. Using AI Tools and Data Analysis can eliminate the confusion of Plan Committee meetings

The goal of most plan committee meetings is to understand current plan dynamics and outcomes and take appropriate actions when needed. Unfortunately, the typical delivery of information simply creates confusion and, in many cases, causes professionals with 27 other things on their plate for the day to simply check out. When clear understanding and knowledge is the end goal for plan fiduciaries, and HR tech can provide the time to focus on understanding by delivering clear elegant data up front.

Charlene Edwards, previously VP of HR at Kloeckner Metals, one of the largest metals manufacturing, supply, and service companies in North America , explained via email. “Where many people view HR tech as a human replacement, I view it as a bridge to a very real gap between HR and plan outcomes analysis. HR Tech, implemented properly, can actually add to the human element the industry has lost sight of in the past.”

Ms. Edwards said she believes HR pros can get overwhelmed with the over analysis and investment jargon associated with Plan Committee discussions and reporting, making it impossible for them to be more proactive in their plan committee discussion. By using artificial intelligence and deep data analysis, they’re able to focus on making decisions that benefit their plan participants and bringing the best decisions to bear quickly. A focus on using HR Tech to take the complex and make it elegant and simple to understand is what aligned her with their investment advisor – Retirement Fund Management in Atlanta, GA.

Tip: Help plan committees be more productive and motivated in their decision process by first understanding what opportunities for improvement are holding the 401(k) or 403(b) plans back. Before signing up for HR software, ask committee members what is preventing them from understanding plan outcomes. Then, research which software can take care of these tasks and free up their time to target the decision-making process.

2. Provides mission critical information on demand

There’s no doubt that things in a Plan Committee meeting move fast. HR Pros are often asked to process reams of financial data in minutes and then decide on some change to a fund in the line-up. So, investment professionals often forget to stop and ask Committee members for feedback.

There’s no doubt that things in a Plan Committee meeting move fast. HR Pros are often asked to process reams of financial data in minutes and then decide on some change to a fund in the line-up. So, investment professionals often forget to stop and ask Committee members for feedback.

Chip Hunt, Founder and President of PrimeTrust Advisors https://primetrustadvisors.com/, and one of the top performing Plan advisors tracked by Veriphy, said he believes that the introduction Plan Outcomes feedback provides the mechanism to deliver high quality decision-making advice to plan fiduciaries without diving into all the investment analytics that often cause committee members to check-out.

“The emergence of plan outcomes feedback helped to change this by encouraging committees to ask key future focused questions, instead of waiting for an annual review,” Hunt said via email. “Creating an environment in which it’s okay to address the brutal facts, regardless of where they are coming from, means that information flows more freely throughout the committee meeting and leads to better decisions.”

Enhancing feedback through plan outcomes transparency, especially by offering the autopsy without blame, gives committee members the information they need to have a more meaningful dialogue on critical plan decisions.

3. Trust but Verify

One of the key relationships that exist for HR leaders is the one between them and the retirement Investment Professionals. This is a relationship that generally has a high degree of trust. If that trust is missing, it may be time to find a new investment professional. That “high trust” however, needs to be checked against performance.

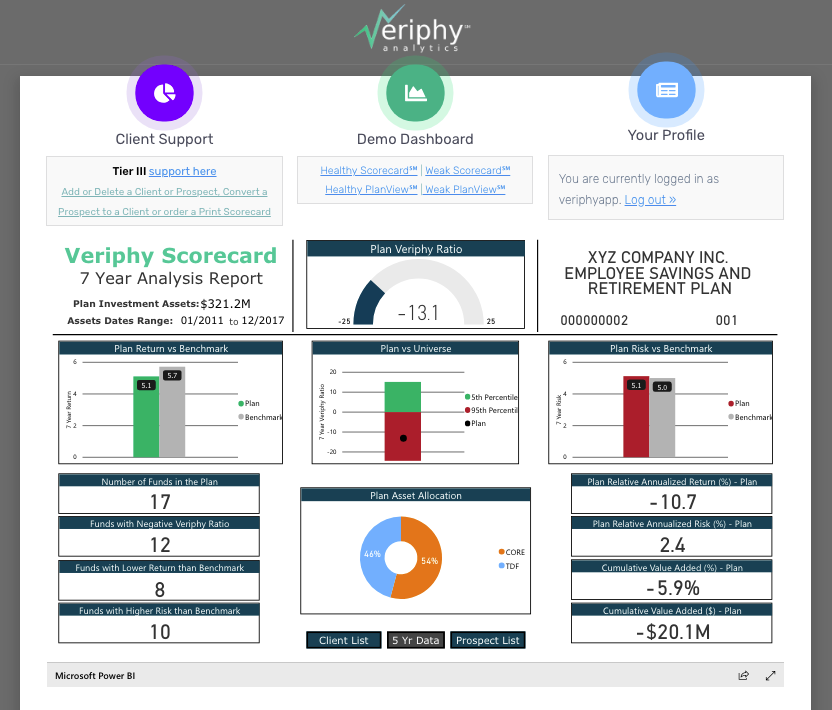

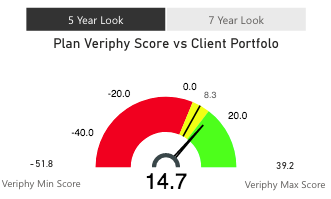

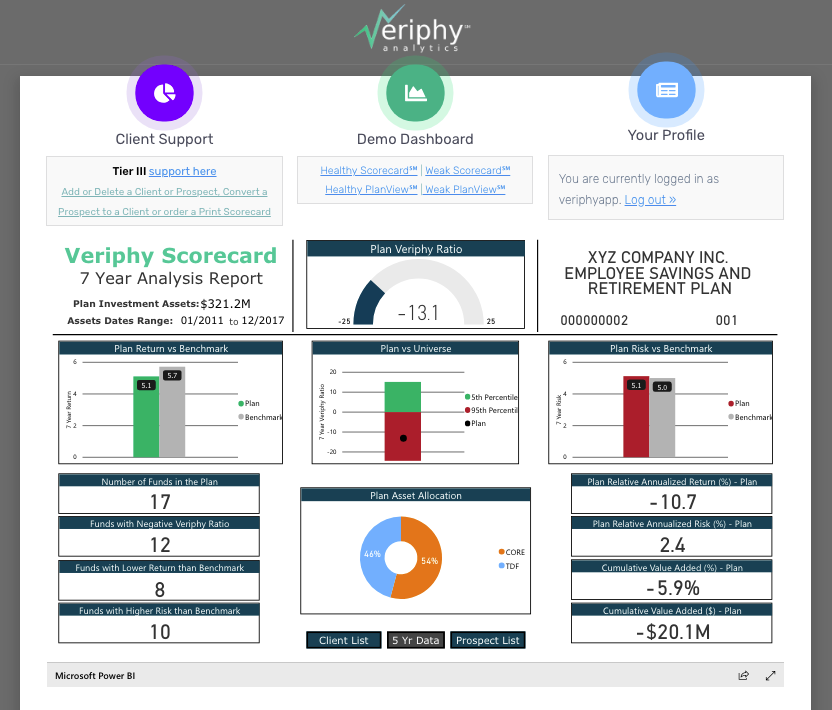

In the past, measuring value added by investment recommendations was elusive at best. However, with the introduction of data analytics and artificial intelligence, it is now possible to measure the performance of a plan vs. its unique benchmark. This is a process developed by Veriphy Analytics and is patent pending. Plan dashboards are used to understand:

-

- Has value been added to our participant accounts?

-

- How much value has been added over time?

-

- How does that compare to the fees we paid?

-

- Do we have opportunities for improvement?

- Which opportunities should we address first?

With the lack of time available for in-depth performance analysis, dashboard provide an elegant way to understand plan dynamics quickly. This gives the committee the ability to make prudent decisions quickly and accurately.

- Improved Decision-Making Leads to Improved Financial Health

With AI created dashboards and drill downs focused on pinpointing where and when value is received, Plan Committee members are able to take what were once limited and confusing standard set of procedures and create improved, more decisive changes for their Plans. Such experiences are especially relevant for improving the financial health of a Plan’s participants and this leads to improved Corporate financial health.

Tip: With tools like Veriphy Analytics PlanView Report, a business intelligence platform for 401(k) Plan Committees, fiduciaries are able to see where value has been added, calculate how much value and determine where it came from. This is delivered in a simple and elegant set of graphics on an interactive dashboard. The platform allows users to be shown and to choose from a variety of screens to find the improvement opportunities that are right for them.

Whether simply trying to understand how a plan actually performs or to determine the details of value attribution, Plan Committees need tools individualized to their needs — not everyone else’s. With HR tech, professionals like Retirement Fund Management (RFM) https://rfm401k.com/ now have the tools to measure and monitor through improved, Plan Outcomes analysis.

Al is the Co-Founder and CEO of Veriphy℠, a 35-year veteran of the financial services industry and has spent the majority of his career as an independent RIA.

Al is the Co-Founder and CEO of Veriphy℠, a 35-year veteran of the financial services industry and has spent the majority of his career as an independent RIA.  There’s no doubt that things in a Plan Committee meeting move fast. HR Pros are often asked to process reams of financial data in minutes and then decide on some change to a fund in the line-up. So, investment professionals often forget to stop and ask Committee members for feedback.

There’s no doubt that things in a Plan Committee meeting move fast. HR Pros are often asked to process reams of financial data in minutes and then decide on some change to a fund in the line-up. So, investment professionals often forget to stop and ask Committee members for feedback.